Best Stress-Relief Gadgets to Buy in March 2026

Valentines Day Gifts for Him 5PC Fidget Toys Adults Set Fidgets for Classroom Must Have Autism Sensory Pack Figette Cube ADHD Special Treasure Prize Tool Stress Relief Desk Cool Gadget for Kids Teen

- RELIEVE STRESS AND ANXIETY WITH VARIOUS ENGAGING FIDGET TOYS.

- SAFE, DURABLE, AND NON-TOXIC; PERFECT FOR WORRY-FREE PLAYTIME.

- IDEAL GIFTS FOR ALL AGES; BOOST FOCUS AND SENSORY DEVELOPMENT!

Fidget Toys Adults Sensory Stone: 6 Pack Textured Worry Stone for Autism Kids Calming Down - Fidget Stress Toys for Anxiety Relief - Small Students Prizes Fidget Toys

-

STRONG STIMULATION FOR ADULTS: IDEAL FOR EFFECTIVE STRESS RELIEF ANYTIME.

-

POCKET-SIZED & QUIET: DISCREET FIDGETING FOR OFFICES AND CLASSROOMS.

-

DURABLE & WASHABLE: LONG-LASTING QUALITY FOR REPEATED USE AND EASY CARE.

Schylling Globby

- RELIEVE STRESS ANYTIME WITH GLOBBY’S STRETCHABLE, FUN DESIGN!

- PERFECT FOR FIDGETING AT WORK, SCHOOL, AND PARTIES-EVERYONE LOVES GLOBBY!

- IDEAL GIFT FOR ALL AGES-GREAT FOR STOCKINGS, BASKETS, AND PROMOTIONS!

luckdoor Silicone Magnetic Balls Fidget Toys for Adults & Teens,4PCS Stress Relief Sensory Toys for Autism ADHD Anxiety,Fun Textures Gadgets,Office Desk Toy,Stocking Stuffers for Women Men Teen Gift

-

ENHANCE FOCUS & SKILLS: BOOST HAND-EYE COORDINATION THROUGH FUN PLAY.

-

CALM & SOOTHE: ALLEVIATE STRESS WITH UNIQUE SENSORY TEXTURES.

-

SAFE & PORTABLE: DURABLE, NON-TOXIC DESIGN WITH CONVENIENT STORAGE.

Schylling NeeDoh Nice Cube -Sensory Squeeze Toy with Super Solid Squish - 2.25" Cube

- SQUEEZE FOR STRESS RELIEF: FUN THAT FITS IN YOUR PALM!

- BRIGHT COLORS BRIGHTEN ANY SPACE-PERFECT FOR GIFTS!

- VERSATILE FOR ALL AGES: FUN FOR KIDS AND ADULTS ALIKE!

Candescent Stress Balls - Hand Therapy Relief for Anxiety, Fidget, Tension, Exercise Strengthener - Motivational Toys for Adults & Kids - Set of 2 (Crystal Blue, Ocean Blue)

-

RELIEVE STRESS AND TENSION FOR IMPROVED FOCUS AND PRODUCTIVITY!

-

GREAT FOR ANXIETY RELIEF-WORKOUT YOUR HANDS AND RELAX YOUR MIND!

-

THOUGHTFUL GIFT WITH MOTIVATING QUOTES-PERFECT FOR ANY OCCASION!

Infinity Cube Sensory Fidget Toy, EDC Fidgeting Game for Kids and Adults, Cool Mini Gadget Best for Stress and Anxiety Relief and Kill Time, Unique Idea That is Light on The Fingers and Hands

- FIDGET LIKE A BOSS-PERFECT FOR ALL AGES AND OCCASIONS!

- STRESS RELIEF MADE FUN-COMBAT ANXIETY QUIETLY AND EFFECTIVELY.

- ENHANCE FOCUS AND FINGER FLEXIBILITY WITH ADDICTIVE PLAY!

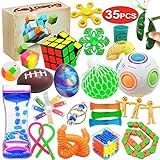

Scientoy Fidget Toy Set, 35 Pcs Sensory Toy for ADD, OCD, Autistic Children, Adults, Anxiety Autism to Stress Relief and Anti Anxiety with Motion Timer, Perfect for Classroom Reward with Gift Box

- 35 DIVERSE TOYS FOR ULTIMATE STRESS RELIEF & FOCUS

- HIGH-QUALITY, SAFE MATERIALS FOR WORRY-FREE PLAY

- PERFECT GIFT BOX FOR KIDS’ BIRTHDAYS & SPECIAL OCCASIONS

Trading stocks can be exhilarating and full of potential, but it can also be mentally and emotionally demanding. Avoiding burnout in active stock trading is crucial for maintaining a healthy mindset and making sound decisions. Here are some key points to consider:

- Set realistic goals: Establish achievable objectives that align with your investment strategy. Avoid excessive expectations that can put undue pressure on yourself.

- Maintain a balanced schedule: Create a routine that provides ample time for relaxation, exercise, and spending time with loved ones. Set boundaries and avoid letting trading consume all aspects of your life.

- Take regular breaks: Frequent breaks during trading sessions can help prevent mental fatigue. Step away from the screen, clear your mind, and engage in activities that help you relax and recharge.

- Diversify your activities: Don't let trading be the sole focus of your day. Engage in hobbies, pursue other interests, and broaden your horizons beyond the world of stocks. This will provide a healthy balance to your life and prevent burnout.

- Manage risk effectively: Set clear stop-loss orders and stick to them. This will protect you from significant losses and reduce the stress associated with making impulsive decisions.

- Practice self-care: Prioritize self-care to maintain physical and mental well-being. Get enough sleep, eat a balanced diet, exercise regularly, and practice stress reduction techniques such as meditation or deep breathing exercises.

- Seek support and socialize: Connect with other traders, friends, or mentors who can provide guidance, share experiences, and offer support. This can help alleviate stress and give you different perspectives on trading challenges.

- Keep emotions in check: Emotional reactions have the potential to cloud judgment and lead to irrational decisions. Learn techniques to manage emotions such as keeping a trading journal, practicing mindfulness, and taking a moment to assess your feelings before making critical choices.

- Review and reflect: Regularly review your trading strategies, successes, and failures. Learn from your experiences and use them to refine your approach. This reflection helps build resilience and a learning mindset.

- Take breaks from the market: Consider taking brief breaks from trading during periods of significant volatility or when you notice signs of burnout. This can provide a chance to recalibrate and avoid making rash decisions.

Maintaining a balanced approach, setting realistic expectations, and focusing on self-care are essential for avoiding burnout while actively trading stocks. By adopting a mindful and strategic mindset, you can improve your overall well-being and achieve long-term success in the stock market.

What are some effective stress-management techniques for traders?

- Deep Breathing and Relaxation Techniques: Practice deep breathing exercises and other relaxation techniques like progressive muscle relaxation to reduce stress and bring a sense of calm.

- Exercise and Physical Activity: Engage in regular exercise or physical activities like yoga, jogging, or walking to release stress, improve mood, and increase overall well-being.

- Time Management: Properly manage your time by prioritizing tasks and setting realistic goals. This helps keep stress at bay and prevents feeling overwhelmed.

- Meditation and Mindfulness: Incorporate mindful meditation practices into your routine to cultivate a calm and focused mindset while reducing stress. This can also improve decision-making abilities.

- Take Breaks and Disconnect: Allow yourself regular breaks during trading hours to recharge and relax. Additionally, set boundaries and disconnect from work-related activities outside of trading hours.

- Maintain a Healthy Lifestyle: Eat a balanced diet, get enough sleep, and limit caffeine and alcohol consumption. A strong physical foundation aids in stress management.

- Seek Social Support: Connect with fellow traders or join support groups to share experiences and coping strategies. Talking to others who understand your challenges can provide valuable support.

- Accept and Adapt: Understand that not all trades will be successful, and losses are a part of trading. Learn to accept failures, adapt to changes, and avoid dwelling on past mistakes.

- Journaling: Keep a trading journal to track thoughts, emotions, and trading patterns. This can help identify stress triggers and develop strategies to manage them.

- Seek Professional Help: If stress becomes chronic or overwhelming, consider seeking guidance from a mental health professional who specializes in stress management or cognitive-behavioral therapy.

What are some strategies for diversifying trading activities to prevent burnout?

- Trade in multiple markets: Instead of focusing on one market, diversify your trading activities by trading in multiple markets. This can involve trading in different asset classes such as stocks, commodities, cryptocurrencies, or forex. By spreading your trades across various markets, you can reduce the risk of burnout that may arise from consistently monitoring a single market.

- Timeframe diversification: Instead of solely focusing on short-term trades, consider diversifying your trading activities by incorporating longer-term trades as well. In addition to day trading or swing trading, you can also explore position trading or investing in long-term trends. Varying your timeframes can provide a different trading experience and help prevent burnout from constantly monitoring short-term price movements.

- Automation and algorithmic trading: Implementing automated or algorithmic trading strategies can help diversify your trading activities. By utilizing pre-defined rules and algorithms to execute trades, you can reduce the need for continuous manual involvement. This allows you to explore different trading styles and strategies without being overwhelmed by constant monitoring.

- Relying on multiple trading strategies: Instead of relying solely on one trading strategy, diversify by using multiple strategies simultaneously. For example, you can employ trend-following, breakout, or mean-reversion strategies in your trading activities. Utilizing different strategies can provide exposure to various market conditions and reduce the risk of burnout resulting from stagnant or ineffective approaches.

- Engaging in other activities: Trading can be demanding and time-consuming, making it essential to take breaks and engage in other activities. Find hobbies or pursue interests outside of trading to balance your life and prevent burnout. Additionally, regular exercise, socializing, and relaxation techniques can help reduce stress and improve overall well-being, allowing you to approach trading with a fresh mindset.

- Collaborating and learning from others: Engage with other traders, either through communities, forums, or trading groups. By sharing experiences, insights, and strategies, you can learn from others and diversify your trading activities. Networking with like-minded traders can also provide emotional support and motivation, helping to prevent burnout.

- Take scheduled breaks: Trading can be stressful, especially during periods of high market volatility. It is crucial to take scheduled breaks to recharge mentally and physically. Consider incorporating regular days off, vacations, or trading sabbaticals, where you completely disconnect from trading activities. Giving yourself time away from trading can help refresh your mind and prevent burnout in the long run.

Remember, diversification should not be pursued recklessly. It is essential to thoroughly understand different markets, strategies, or automated systems before implementing them into your trading activities.

How to manage emotions and avoid burnout while trading stocks?

Managing emotions and avoiding burnout while trading stocks can be challenging, but with these strategies, you can take control of your emotions and trading activities:

- Set realistic expectations: Understand that trading stocks involves both gains and losses. Set realistic goals, and avoid getting carried away by short-term expectations. Recognize the volatility of the market and accept that losses are a part of the process.

- Develop a well-defined trading plan: Create a trading plan that outlines your trading goals, strategies, risk tolerance, entry and exit points, and position sizing. This plan will help you stay disciplined and reduce impulsive decision-making.

- Practise risk management: Establish a risk management strategy, such as setting stop-loss orders to limit potential losses. This will provide a buffer against large unfavorable market movements and lessen emotional stress.

- Avoid over-trading: Over-trading can lead to exhaustion and poor decision-making. Stick to your trading plan and avoid making impulsive trades based on emotions or short-term market fluctuations.

- Take breaks and rest: Regularly taking breaks, both during trading sessions and on days off, is important for maintaining mental clarity and avoiding burnout. Engage in activities that help you relax and recharge.

- Separate emotions from trading decisions: Emotions such as fear and greed can cloud judgment. Make decisions based on analysis and strategy rather than impulsive reactions. Create a routine or develop mindfulness techniques to better regulate emotions.

- Focus on continuous learning: Stay updated on market trends, news, and trading strategies. Continuous learning can enhance your understanding of market dynamics and increase confidence in your decision-making, reducing emotional stress.

- Seek support: Building a community of fellow traders or joining online forums can provide support, advice, and a platform to discuss your trading experiences. Sharing and learning from others can help manage emotions and prevent burnout.

Remember, managing emotions and avoiding burnout is an ongoing process. It requires self-awareness, discipline, and a commitment to self-care.

What is the role of mindfulness in preventing burnout among traders?

Mindfulness can play a significant role in preventing burnout among traders. Here's how:

- Managing stress: Trading can be a high-stress profession, with constant pressure to make profitable decisions. Mindfulness techniques, such as deep breathing, meditation, or body scan exercises, help traders manage stress levels, reduce anxiety, and increase emotional resilience.

- Enhancing focus and concentration: Mindfulness practices train the mind to stay present and focused on the current moment. By practicing mindfulness, traders can improve their ability to concentrate, make sound decisions, and avoid distractions. This can help prevent burnout caused by mental exhaustion and information overload.

- Increasing self-awareness: Mindfulness cultivates self-awareness, allowing traders to recognize and acknowledge their emotions, thoughts, and physical sensations without judgment. When traders are aware of their stress levels, triggers, and limits, they can take appropriate steps to prevent burnout, such as taking breaks, engaging in self-care, or seeking support.

- Promoting work-life balance: Mindfulness encourages individuals to find a balance between work and personal life. Traders often work long hours, which can lead to burnout when work dominates their lives. By practicing mindfulness and being fully present during non-work activities, traders can create boundaries, reduce stress, and find more fulfillment in their personal lives.

- Cultivating resilience: Mindfulness helps traders develop resilience, which is crucial for preventing burnout. By cultivating resilience, traders can bounce back from setbacks, adapt to changing market conditions, and maintain a positive attitude during challenging times.

Overall, by incorporating mindfulness into their daily routines, traders can reduce stress, improve focus, gain self-awareness, promote work-life balance, and build resilience, thus protecting themselves against burnout.

How to manage expectations and avoid burnout in a fast-paced trading environment?

Managing expectations and avoiding burnout in a fast-paced trading environment can be challenging, but with the right strategies, it is possible. Here are some tips to help you:

- Set realistic expectations: Understand that the trading environment is fast-paced and volatile. Avoid setting unreachable goals or putting undue pressure on yourself. Instead, focus on setting realistic and achievable targets.

- Prioritize and plan: Identify your most critical tasks and prioritize them accordingly. Make a daily or weekly plan that outlines your goals and allocate appropriate time to each task. This will help you stay organized and avoid feeling overwhelmed.

- Take breaks and practice self-care: It's important to take regular breaks and engage in activities that help you relax and recharge. Breaks can be as simple as taking short walks, practicing mindfulness, or doing activities you enjoy. Taking care of your physical and mental well-being is crucial to avoid burnout.

- Learn to delegate: Accept that you cannot do everything on your own. Delegate tasks to trusted colleagues or consider automating certain processes. Sharing the workload will help alleviate stress and prevent burnout.

- Develop a support system: Surround yourself with a supportive network of colleagues, mentors, or friends who understand the demands of the trading environment. Discussing challenges and seeking advice or guidance can help you manage expectations and provide you with the necessary support.

- Manage your time effectively: Time management is critical in a fast-paced trading environment. Learn to prioritize tasks, avoid unnecessary distractions, and establish efficient work routines. Techniques like the Pomodoro Technique, which involves working in focused sprints with regular breaks, can be useful.

- Maintain a healthy work-life balance: Establishing boundaries between work and personal life is essential. Create dedicated time for activities outside of work that you enjoy and ensure you spend quality time with family and friends. Remember, burnout can be prevented by maintaining a healthy balance.

- Learn from mistakes: Mistakes and losses are a part of trading. Instead of dwelling on them, focus on learning from them to improve your skills and decision-making. Embrace a growth mindset and view setbacks as opportunities for growth.

Remember, managing expectations and avoiding burnout in a fast-paced trading environment is an ongoing process. Be patient with yourself and be open to adapting strategies that work best for you.