Best Strategies to Manage Trading Losses to Buy in February 2026

Trading: Technical Analysis Masterclass: Master the financial markets

- MASTER TECHNICAL ANALYSIS FOR TRADING SUCCESS TODAY!

- ENHANCE YOUR MARKET SKILLS WITH PREMIUM QUALITY INSIGHTS.

- UNLOCK FINANCIAL MARKET STRATEGIES TO BOOST YOUR PROFITS!

Trading in the Zone: Master the Market with Confidence, Discipline and a Winning Attitude

- ENGAGING READS FOR PASSIONATE BOOK LOVERS.

- PERFECT FOR ENHANCING YOUR READING EXPERIENCE.

- IDEAL GIFT FOR AVID READERS AND BOOK ENTHUSIASTS.

How to Day Trade for a Living: A Beginner’s Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology (Stock Market Trading and Investing)

-

WORK ANYWHERE, ANYTIME: INDEPENDENCE AS A DAY TRADER.

-

MASTER YOUR SUCCESS: TOOLS AND MOTIVATION ARE KEY!

-

NOT GAMBLING: BUILD REAL SKILLS FOR PROFITABLE DAY TRADING.

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

- PERFECT GIFT CHOICE FOR BOOK LOVERS AND AVID READERS!

- COMPACT DESIGN MAKES IT TRAVEL-FRIENDLY AND CONVENIENT.

- THOUGHTFUL PRESENTS FOR ANY OCCASION-DELIGHT YOUR LOVED ONES!

Best Loser Wins: Why Normal Thinking Never Wins the Trading Game – written by a high-stake day trader

How to Day Trade: The Plain Truth

The Trader's Handbook: Winning habits and routines of successful traders

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.blogweb.me/1/41e_Ap_i_Cp_LL_SL_160_c295e2efb5.jpg)

The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible: [3 in 1] The Ultimate Guide to Mastering Candlestick Techniques, Chart Analysis, and Trader Psychology for Market Success](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.blogweb.me/1/51_Jozc_NDI_6_L_SL_160_442c988b69.jpg)

The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

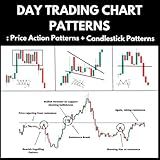

Day Trading Chart Patterns : Price Action Patterns + Candlestick Patterns

Handling losses in day trading can be tough, but it is important to stay calm and composed. One key aspect is to have a solid risk management strategy in place. This includes setting stop-loss orders to limit potential losses and not risking more than a certain percentage of your capital on any single trade.

It is important to remember that losses are a part of trading and are inevitable at times. It is crucial to not dwell on past losses and instead focus on the next opportunity. Analyze the reasons behind the loss, learn from it, and adjust your strategy or approach accordingly.

Emotional control is also important when dealing with losses in day trading. It can be tempting to try and quickly make up for a loss by taking on more risk, but this can lead to even greater losses. It is important to stick to your trading plan and not let emotions dictate your decisions.

Seeking support from fellow traders or a mentor can also be helpful when dealing with losses. They can provide guidance, advice, and perspective to help you navigate through difficult times. Remember to stay disciplined, stay focused, and always keep learning and growing as a trader.

What is the significance of seeking professional help or guidance in handling losses in day trading?

Seeking professional help or guidance in handling losses in day trading is significant for several reasons:

- Emotional support: Day trading can be a very stressful and emotional activity, especially when losses occur. A professional can provide emotional support and help traders cope with the emotional rollercoaster that often comes with day trading.

- Risk management: Professionals can provide traders with strategies and tools to effectively manage risk and minimize losses. They can help traders develop a risk management plan tailored to their individual trading goals and preferences.

- Skill development: Professionals can help traders improve their trading skills and develop a deeper understanding of the market. They can provide guidance on technical analysis, market trends, and trading strategies that can help traders make more informed decisions.

- Accountability: Working with a professional can help traders stay disciplined and accountable for their actions. A professional can provide feedback, monitor performance, and help traders stay on track with their trading goals.

Overall, seeking professional help or guidance in handling losses in day trading can help traders navigate the complexities of the market, manage risk effectively, and ultimately improve their chances of success in trading.

What is the importance of staying calm and composed when facing losses in day trading?

Staying calm and composed when facing losses in day trading is important for several reasons:

- Rational decision-making: Being calm and composed allows traders to make rational decisions based on analysis and research rather than emotions. Emotions can often cloud judgment and lead to impulsive or irrational decisions that can result in greater losses.

- Avoiding further losses: Panic and emotional reactions to losses can often lead to more losses as traders may engage in desperate or risky behavior to try and recoup their losses. Staying calm helps traders avoid making hasty decisions that could worsen their financial situation.

- Maintaining focus: Stay calm and composed helps traders to maintain focus and concentration on their trading strategy and goals. This can help them stay disciplined and stick to their plan even in the face of setbacks.

- Psychological well-being: Trading can be a stressful and emotionally taxing activity, especially when facing losses. Staying calm can help traders maintain their psychological well-being and prevent burnout or other negative consequences of stress.

Overall, staying calm and composed when facing losses in day trading is essential for making sound decisions, preventing further losses, maintaining focus, and protecting mental health.

How to cope with losses in day trading?

- Accept that losses are part of trading: Understand that losses are inevitable in day trading and are a natural part of the process. It is important to accept that losses will happen and to not dwell on them too much.

- Keep emotions in check: Emotions can cloud judgment and lead to irrational decision-making. It is important to detach emotions from trading and focus on the facts and data.

- Stick to a trading plan: Having a well-defined trading plan can help guide your decisions and provide structure to your trading. Stick to your plan and avoid making impulsive decisions based on emotions.

- Limit your losses: Set a stop-loss order to limit your losses and prevent them from spiraling out of control. This will help you manage risk and protect your capital.

- Learn from your losses: Use each loss as an opportunity to learn and improve your trading strategy. Analyze what went wrong and identify areas for improvement.

- Take a break: If you are feeling overwhelmed by losses, take a step back and give yourself some time to recharge. This can help you gain a fresh perspective and approach trading with a clear mind.

- Seek support: Consider talking to a mentor, fellow trader, or a therapist to help you cope with losses and provide guidance on how to navigate the challenges of day trading.