Best Stocks for Day Trading to Buy in February 2026

How to Day Trade for a Living: A Beginner’s Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology (Stock Market Trading and Investing)

- WORK FROM ANYWHERE-FREEDOM TO CHOOSE YOUR LIFESTYLE!

- BE YOUR OWN BOSS; ONLY YOU DECIDE WHEN TO TRADE!

- SUCCESS REQUIRES THE RIGHT TOOLS AND RELENTLESS MOTIVATION!

How to Day Trade: The Plain Truth

Day Trading For Dummies

A Beginner's Guide to Day Trading Online (2nd edition)

- QUALITY ASSURANCE: CAREFULLY INSPECTED FOR MINIMAL WEAR AND TEAR.

- AFFORDABLE PRICING: SAVE MONEY WITH OUR BUDGET-FRIENDLY OPTIONS.

- ECO-FRIENDLY CHOICE: PROMOTE SUSTAINABILITY BY BUYING USED BOOKS.

Day Trading Made Easy: A Simple Strategy for Day Trading Stocks

How To Day Trade Stocks For Profit

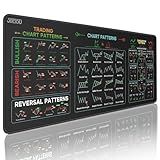

JIKIOU Stock Market Invest Day Trader Trading Mouse Pad Chart Patterns Cheat Sheet,X-Large Computer Mouse Pad/Desk Mat with Stitched Edges 31.5 x 11.8 in

-

UNIQUE DESIGN INSPIRES SUCCESS: GREEN BACKGROUND SYMBOLIZES STOCK MARKET LUCK.

-

EASY-TO-USE TRADING TOOLS: ORGANIZED CHARTS AND INDICATORS FOR ALL SKILL LEVELS.

-

DURABLE & NON-SLIP DESIGN: ENHANCED STABILITY FOR ALL DESK SURFACES AND LONG-LASTING USE.

When selecting the best stocks for day trading, it is important to consider several factors. One of the key considerations is volatility, as stocks with higher volatility typically offer more potential for significant price movements within a single trading day. Liquidity is also important, as stocks with high trading volumes are easier to buy and sell quickly. Additionally, it is crucial to pay attention to the stock's price movement patterns, such as trends and support and resistance levels. Fundamental analysis can also be helpful in identifying strong companies with good growth potential. Traders may also consider using technical analysis tools and indicators to help identify potential entry and exit points for day trading. Overall, it is important to do thorough research and analysis when selecting stocks for day trading to increase the likelihood of successful trades.

How to identify stock catalysts for day trading?

- Earnings reports: Companies usually release their quarterly earnings reports, which may cause significant movements in stock prices. Positive earnings reports can lead to a surge in stock prices, while negative reports can cause a drop.

- News and current events: Keeping up with current events and news can help identify potential catalysts for specific stocks. Positive news, such as a new product launch or a partnership agreement, can cause a stock to rise. On the other hand, negative news, such as a lawsuit or regulatory issues, can cause a stock to decline.

- Analyst upgrades and downgrades: Analysts often release reports with buy, sell, or hold recommendations for specific stocks. These reports can serve as catalysts for stock price movements, especially if they come from well-known analysts or investment firms.

- Economic indicators: Economic data releases, such as employment numbers, GDP growth, or consumer spending, can impact stock prices. Positive economic indicators may lead to an increase in stock prices, while negative indicators can cause a decline.

- Sector-specific news: Industry-specific news, such as regulatory changes, technological advancements, or shifts in consumer behavior, can impact stock prices within that particular sector. Keeping an eye on news related to specific industries can help identify potential catalysts for day trading stocks within that sector.

- Social media and online forums: Social media platforms and online forums can provide real-time information and opinions on specific stocks. Monitoring these platforms can help identify potential catalysts for day trading, such as rumors, speculation, or market sentiment shifts.

- Technical analysis: Analyzing stock charts and technical indicators can help identify potential catalysts for day trading. Patterns such as breakouts, trend reversals, or support and resistance levels can signal potential opportunities for traders.

What is the importance of risk management in day trading?

Risk management is crucial in day trading because it helps traders protect their capital and minimize potential losses. Day trading involves making quick decisions and executing trades in a fast-paced market environment, which can be highly volatile and unpredictable. Without proper risk management strategies in place, traders are at risk of losing a significant portion of their investment in a short amount of time.

By implementing risk management techniques, day traders can set limits on how much they are willing to risk on each trade, determine their position size based on their risk tolerance, and use stop-loss orders to control potential losses. This helps traders to preserve their capital and stay in the game for the long term, even in the face of market fluctuations and unexpected events.

In addition, risk management allows traders to plan ahead and assess the potential risks and rewards of different trading opportunities. By understanding and managing risks effectively, traders can make informed decisions and avoid making impulsive or emotional trades that can lead to significant losses.

Overall, risk management in day trading is essential for protecting capital, preserving profits, and ultimately, achieving long-term success in the markets.

What is the best timeframe for day trading?

The best timeframe for day trading typically ranges from very short-term (1-5 minute charts) to short-term (15-minute or 30-minute charts). It ultimately depends on the individual trader's style, preferences, and risk tolerance. Some traders may prefer to focus on very short-term charts for quick scalping trades, while others may prefer slightly longer timeframes for more stable trends. It is important for day traders to experiment with different timeframes to determine what works best for them.

What is the role of volume in selecting stocks for day trading?

Volume is a crucial factor to consider when selecting stocks for day trading. Here are some reasons why volume is important:

- Liquidity: Stocks with high volume are more liquid, meaning there are more buyers and sellers trading the stock, making it easier for traders to enter and exit positions quickly without significant impact on the stock's price.

- Volatility: Higher volume stocks tend to have more price movements throughout the day, providing more opportunities for traders to profit from short-term price fluctuations.

- Confirmation: Volume can act as a confirmation indicator for price movements. A significant increase in volume when a stock is moving in a certain direction can indicate that the price movement is more likely to continue.

- Spread: Stocks with higher volume typically have narrower bid-ask spreads, reducing trading costs for day traders.

Overall, volume is a key indicator that can help day traders identify potential trading opportunities and make informed decisions when selecting stocks to trade.